So there I was, trying to figure out how to get into this move, I missed my entry for whatever reason but I knew by chasing it that I was only setting myself up to buy the high of the bar just as the market reversed on me. I'm sure this never happened to anyone else but it seemed to happen to me all the time. Just look at the chart, the stoch is overbought and I should be thinking about a short here, but a long....what am I thinking? Well, first of all, "IF" I was lookin to short the market the price would have to take out the low of the setup bar and that didn't happen so I guess using price to confirm trades might be a good idea....who knows?

So I started to study the internals by attending several of LBR's workshop, in fact, I even had a private workshop at her office in FLA over a weekend and went deep, deep, into market structure. 99.9% of all day traders use either an indicator or a group of indicators to determine when a trade is setting up. But indicators are based on some average of closed bars, which means you are just fooling yourselves if you believe price is going to go up because your secret sauce is pointing north.

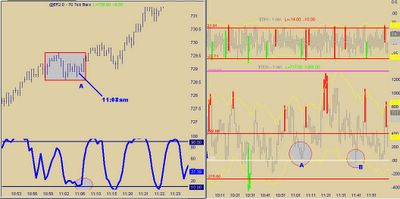

As the market starts to run, when is it safe to entry and join in the rally is a major question we all have faced, nothing worse (Besides losing money) then watch the market run for 5, 8 or 12 points and you can't find a safe defined way to entry. That is one reason, I drop down to a 70t chart so I can see the market pause or go sideways as the $TICK move back to zero....which I call a TAZ since it's easy to type. Thursday was a classic day for the TAZ....market moved up....went sideways....ticks back to zero.....and then up we went.....in fact in TradersHaven on relay7 in hotcomm.com it actually got a little boring in there just this setup..........

But looking at this chart, we see the $TICK had moved back to zero, the stoch I like to use cycled down and when the $TICK lifted........well it was good for a number of reason including the limited risk if I was wrong......me wrong.....did I say that out loud?

Well, of course the first example was a golden trade and we are now near outer space on this rally....could we actually get more? Well, the $TICKS pulled back again to zero while the price held firm.......stoch cycled down and $TICK popped up and again we moved higher.......in fact at 11:57 we had yet another one of these scalp type setups........boring I say......boring in a trending market.......

5 comments:

Thanks also Dennis for sharing this with the group.

Dennis thank you for sharing your experiences. They are invaluable.

Dennis,

Thanks for shareing that with us. How's your MOAS working these days? Was just woundering if it was still going stong.

Mario

Dennis, Thanks for the TAZ write up. Do you use price confirmation for entry off the 70T aftet the ticks have started their move or just watch for the ticks to make their move and jump in?

could someone tell me how to set up a chart like Dennis's basic 3 min chart. I can do the bolze stoch, but need help with the cci. Specifically, how to set up the paintbars and what is the criteria for them changing from green to red and vice versa. Also, what are the 2 values of the cci's? I am pretty sure the yellow is a 50, but not sure of what length the blue one is. Thanks in advance

Post a Comment