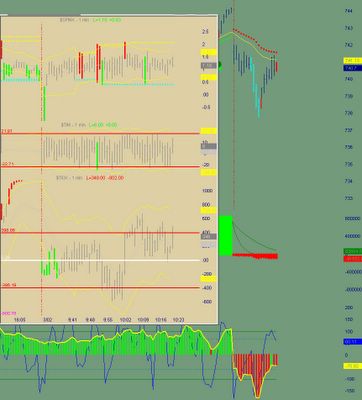

Today, as usual you have conflict between setups......the ideal setup, the "50 CCI ZLR" with the secret sauce was setting up a short just after 10:00am. Meanwhile, the ticks had been below zero, came up to the 400 area and then came back to form a TAZ (ticks at zero) for a long setup. Which one to take is the question.

So you had a loser there unles you are using a wider stop then the rest of us and maybe still paper trading, but a batman formed...remember the batman it's one of the 23 CCI official setups and again if you used just the indicator you were short yet again........

In real live trading, you can't get it back by pretending it never happened......"Oh look did you get that Shamu"....."WOW, that was a great trade". Or, did everyone get that inverted ghost, it was worth 6 points. If you use price to confirm your setups, you would have taken the TAZ like we did in the TraderHaven chat room on relay7 in hotcomm.com and been very happy. There were 4 ZLR setups to short this morning......because the CCI has to be above by 6 bars before the trend changes......officially. Now who likes to short the market during a rally......no one I know......but hey, they don't need no stinking 50 and they don't need no stinking prices and they don't need nothing else that stinks....or anybody else and that is just fine with the traders in all the other chat rooms it appears.....

5 comments:

Dennis,

Can you show us a 70t chart at that TAZ ?

Thanks,

Mario

Hey Dennis. There is more crossing of the 0 line on the $TICK chart than Mexicans crossing the border. How in the hell you determine which crossings are meaningful is way beyond me.

Hi Dennis,

I created a 1 minute $TICK chart to reproduce what you showed in your examples ... I can't pick out the "trigger" event that tells you to enter the trade. Can you expain this further?

TIA

David

Hi Denis

Where can I find a list of the 23 official CCI setups? I found many mentioned on the tradershaven forum, but which of them are the official ones?

Thanks, Joey (new to your blog)

For those people who were also looking what parameters Dennis uses for his stochastic.... Here is some info :

"The Bressert Double Stochastic is an improvement over the standard stochastic in that it wiggles less providing fewer false signals, and has greater amplitude in trending markets."

http://www.walterbressert.com/pages/ProfitTrader/Educational/DoubleStoc/DoubleStoc1.htm

Let's hope this is the holy grail (: LOL

Post a Comment