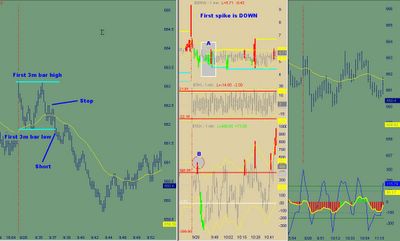

The first bar trade is a simple idea that everyone seems to have trouble with. The chart on the right is a 3 minute ER chart and the chart on the left is a 70 tick chart of the ER. The chart in the middle is the prem, tiki and tick on a 1 minute chart.

The market opens and I wait until 9:33 and then will take the breakout of the first bar. Today was a classic because it had two inside bars after the first bar printed.

That just means those bars did not take out either the high or the low during each of their 3 minutes.

When it took out the low, without taking out the high on the same bar, then I shorted and used 652.5 for a stop. Why there???? well the first up spike in the tiki was at the time and price(POINT "B") .....so why just use the high of the first bar or a fixed stop......keeping the risk small is important.

Then around 9:42 again we had the first bar after 9:42 outside the KC which again was to the down side.....and look how the day unfolded......

The interesing point was the 50CCI had a nice ZLR on the open. However, with the spread being in the green I had to view this as a type 3 trade setup or a scalp instead of an ideal setup. But that is OK....

If you are using some kind of RSI, STOCH or some other OSC........then when it is oversold....move to breakeven take half off and use the 3m high as a trailing stop......that is how I have fun every morning....GREAT TRADING.

Develop a trading plan, and then just stay true to yourself....simple as that!!!!

8 comments:

Dennis.....you say that after the first bar if you take out the low of that bar as long as you haven't taken out the high you go short. Well if it took out the high, then wouldn't you be long? Or do you wait for the takeout bar to close before entering. Otherwise it's not possible to take out the top and bottom of a bar and not already be in when the first event occurred.

Anonymous

I think Dennis has a bias coming into the first bar of which way to go. So in this case he was looking to get short in the direction of the 50cci, or possibly the first spike DOWN in the prem.

Dennis, can you confirm?

When we have an outside bar, after the first 3m bar, I will do a blog about that because I pic is worth 1,000 words.

And Yes, there could be a bias based on one other thing which we will also go into as we move forward.

my 3 min data is different, my 3rd bar takes out the frist 3 min bar high, so it would be long. guess i try to code this setup up and see.

Mike____

The rules are the same, sorry that your bandwidth or processer or whatever is not collecting the same data as I do. But I only use my charts to find a setup for the next trades. Maybe you sure, like Cometguy and have several data feeds so you can decide which one is dropping ticks.....

Dennis

please define for me some of the terminology you use.

Use the word 'prem', is simply premium of the futures over spot. (not sure here)

tiki - what's this - please tell,

You have what you call a type 3 trade, a scalp -with a setup. What's the rationale here?

Many thanks if you can enlighten me here.

cheers

Post a Comment