Ever wonder why it seems that people (using a fake name...well duh) bust on me all the time. Well, it's easy to explain in a sense, take the first bar trade. You don't need "ANY" indicators, you don't need any certain trading platform a secret coded sidewinder system or the galaxy universal world super daytrading system.......you just need price bars. So what would they have to sell? What deals could they arrange if all you needed was just price bars. WELL ZIP!!!!

So they spend their time giving me crap so I maybe I will go drift off into cyperspace. WELL,..........by now you should know the answer to that one.

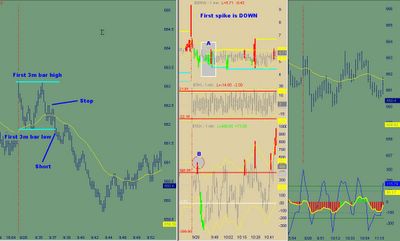

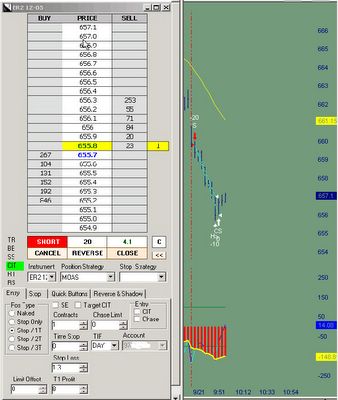

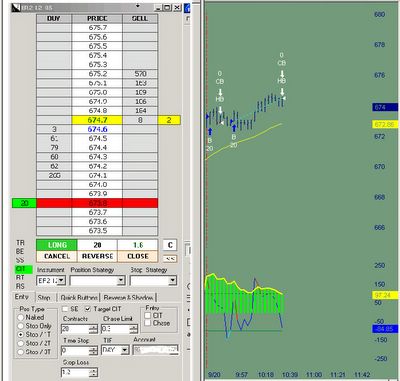

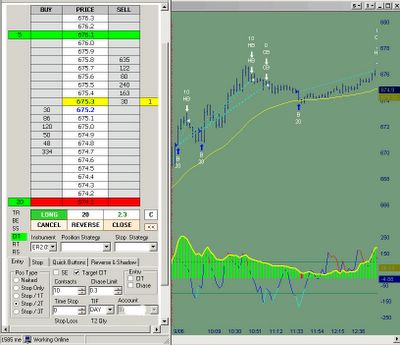

The first bar today had an inside bar during the 9:34 to 9:36 time period, just meaning that neither the high or the low of the first bar was taken out. The rule is after the first bar has printed, if the low is taken out without taking out the high then go short. Since neither were taken out....It's still a valid setup.

Of course, the next question is always, Well Dennis how many inside bar until the setup is voided? ANSWER: Until the market closes. The most I have ever seem is 7 inside bars.......

As far as "your" data not being the same as mine....so your chart are a little different I can only tell you this:

1. Not all computers are the same.

2. Not all computers have the exact same software open during trading.

3. Not all computers process data the exact same.

4. Not all internet providers tranmit the data the same.

5. Dail up doesn't provide the same data as cable.

6. Cable doesn't provide the same data as DSL.

7. If everyone in the neighborhood is on their computers then the cable is different.

8. DSL doesn't provide the same data as a T-1.

9. Not all data providers send the exact same data.

10. and so on.

I use a T-1 full 24 channels to run my FT and TS. There isn't any chat room or chat rooms, browsers any other software packages on the computers that could even be open during trading hours.

Today I was at a prop trading firm in Vegas and as I walked around looking at what those traders were using.....all but 2 were out on the internet playing at some guru website. One trader was short and when I asked him why he said it was because of the all the bad news in the world the market had to sell off.....I didn't take the time to even ask his name........he is just order flow since he was short from yesterday and had moved his stop up a couple of times instead of taking the direct hit.

The rest were also playing around and no one had any logs to take notes and no one really had a clue of what they should be doing........SO I wished them well and went over to the Trade Station World International Universal Cruz Conference and ate a blueberry muffins and washed it down with 3 day old coffee.

There were only 14 booths at the conference once you took out the CBOT, CME, Traders Press and the rags. It took me almost 4.3 minutes to walk around the entire exhibit hall. It would have taken me less time, but I spotted another blueberry muffin and just had to give it to my "BELLYYYyyyyy".

After nine years of day trading, it was interesting to see and hear the pitch as you walked by the booth. Nexgen had 6 people to serve you the best curve fitting "after market" software out there. The charts had over 17 different things on it to give you the EDGE........so call today and I am sure they will send it out.....looked like they could use some business....ROTFL.